As you can see this time, the formula is not very simple and requires a lot of calculations. That’s why it’s worth testing our compound interest calculator, which solves the same equations in an instant, saving you time and effort. In this example you earned $1,000 out of the initial investment of $2,000 within the six years, meaning that your annual rate was equal to 6.9913%. As the main focus of the calculator is the compounding mechanism, we designed a chart where you can follow the progress of the annual interest balances visually. If you choose a higher than yearly compounding frequency, the diagram will display the resulting extra or additional part of interest gained over yearly compounding by the higher frequency. Thus, in this way, you can easily observe the real power of compounding.

How compound interest is calculated

If additional contributions are included in your calculation, the compound interest calculator will assume that these contributions are made at the start of each period. The effective annual rate (also known as the annual percentage yield) is the rate of interest that you actually receive on your savings or investment after compounding has been factored in. To compare bank offers that have different compounding periods, we need to calculate the Annual Percentage Yield, also called Effective Annual Rate (EAR).

What is the compound interest formula?

Historically, rulers regarded simple interest as legal in most cases. However, certain societies did not grant the same legality to compound interest, which they labeled usury. For example, Roman law condemned compound interest, and both Christian and Islamic texts described it as a sin. Nevertheless, lenders have used compound interest since medieval times, and it gained wider use with the creation of compound interest tables in the 1600s. Let’s say you have $10,000 to invest, and you want to know how long it will take to grow to $100,000.

Compound Interest Formula With Examples

More frequent compounding periods means greater compounding interest, but the frequency has diminishing returns. This example shows the interest accrued on a $10,000 investment that compounds annually at 7% for four different compounding periods over 10 years. Interest can be compounded on any given frequency schedule, from continuous to daily, monthly, quarterly to annually. When calculating compound interest, the number of compounding periods makes a significant difference for future earnings.

How to Use the Compound Interest Calculator: Example

The longer the interest compounds for any investment, the greater the growth. It helps individuals make informed decisions about investing, borrowing, and planning for the future by providing accurate projections of how money will grow or diminish over time. The final value after 5 years is $11,041 whereas with simple interest it would have been just $11,000.

Have you noticed that in the above solution, we didn’t even need to know the initial and final balances of the investment? It is thanks to the simplification we made in the third step (Divide both sides by PPP). However, when using our compound interest rate calculator, you will need to provide this information in the appropriate fields. Don’t worry if you just want to find the time in which the given interest rate would double your investment; just type in any numbers (for example, 111 and 222). In the second example, we calculate the future value of an initial investment in which interest is compounded monthly.

- A is the future value of the investment/loan, including interest.

- The money you haven’t paid off will get charged with interest, which is typically compounded daily.

- To understand the math behind this, check out our natural logarithm calculator, in particular the The natural logarithm and the common logarithm section.

- It is therefore recommended that you hunt around for the best deal before settling – see if there is a minimum balance, check online, and beware of additional fees.

- You can use this tool to make informed decisions about your investments or loans by understanding how compound interest affects the overall growth or cost over time.

Compound Interest is calculated on the principal amount and also on the interest of previous periods. Simple interest is calculated only on the principal amount of an investment. When you know the basics of compound interest you’ll be able to make informed investment decisions is net income an asset and boost your net worth over time. Make sure compound interest works for you by investing regularly and trying to increase the frequency of your loan payments. Compound interest is used in many aspects of business transactions, investments, and financial products.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Interest, or the rate that banks charge to lend you money, is an important factor to consider when using credit cards. Here, we’ll cover how interest is calculated — and how you can use these calculations to more responsibly manage your budget and finances.

APY stands for annual percentage yield, otherwise called effective annual rate (EAR). This measurement is used to estimate the potential gain from an investment or the final balance in a deposit account. In order to make smart financial decisions, you have to remember that the final balance depends on a range of aspects.

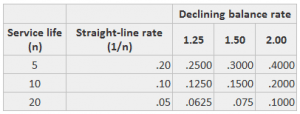

Compound interest tables were used every day before the era of calculators, personal computers, spreadsheets, and unbelievable solutions provided by Omni Calculator 😂. The tables were designed to make the financial calculations simpler and faster (yes, really…). They are included in many older financial textbooks as an appendix. It is also worth knowing that exactly the same calculations may be used to compute when the investment would triple (or multiply by any number, in fact).

Your credit card balance fluctuates throughout a billing cycle based on new purchases or returns, any fees you’re assessed (such as foreign transaction fees), as well as any mid-cycle payments you make. If your credit card issuer uses a compounding interest formula to assess interest (as most of them do), your daily balance will also include any interest accrued from the prior day’s balance. The Rule of 72 is a simpler way to determine how long it’ll take for a specific amount of money to double, given a fixed return rate of return that is compounded annually. It can be used for any investment, as long as there is a fixed rate that involves compound interest. Simply divide the number 72 by the annual rate of return and the result of this is how many years it’ll take. You should always consult a qualified professional when making important financial decisions and long-term agreements, such as long-term bank deposits.

Compound interest is a type of interest in which the interest amount is periodically added to the principal amount and new interest is subsequently accrued over interest from past periods. It is a very powerful tool for increasing your https://www.personal-accounting.org/ capital and is a basic calculation related to personal savings plan or strategy, as well as long term growth of a mutual fund or a stock market portfolio. Compounding interest is the most basic example of capital reinvestment.

In most cases, credit card interest is charged when you don’t pay your full balance by the end of your grace period and decide to carry a balance from month to month. This equation will give you the total amount of https://www.accountingcoaching.online/depreciation/ interest charges you will be charged for the given billing period. Hence, if a two-year savings account containing $1,000 pays a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years.