Compare your options and choose a provider that meets your requirements and, of course, your budget. Outsourcing these tasks to professionals allows you to better manage your cash flow, maintain healthy relationships with your suppliers, and more accurately gauge profitability. Custom plans make it difficult to predict exactly how much you’ll pay per month. Proprietary bookkeeping software could make it difficult to switch to another provider in the future.

Why Do Businesses Use Outsourced Accounting Services?

We’ll reconcile and categorize your transactions, give you monthly financial statements, and put you in direct touch with your new bookkeeper through our messaging app. Advanced technology has made it possible for financial and accounting experts to create better and more accurate financial models than ever before. Without a timely and accurate cash flow forecast, your company may run into future problems and surprises, which is why financial modeling is so important. By creating financial models with a wider range of inputs, you’ll be able to predict future outcomes and opportunities more accurately and plan accordingly.

Increased Financial Clarity

Even if a bookkeeping service has all of these add-ons, they can be expensive, so be sure you understand the total cost before choosing a service. There are a number of benefits that businesses can realize from partnering with an outsourced https://www.kelleysbookkeeping.com/bookkeeping-payroll-services-at-a-fixed-price/ accounting services firm. At a high level, working with an outsourced accounting services firm allows businesses to embrace high-quality accounting processes at a fraction of the cost of managing these processes with an internal team.

You’re our first priority.Every time.

As your company faces a high level of regulation, you can sit back and let your outsourced accounting professionals adhere to compliance requirements with the various regulatory bodies. Since several companies are transitioning to a more hybrid or remote work model, outsourced accountants are much needed in smaller businesses and organizations. Reduce costs, manage taxes, administer benefits, and stay globally compliant when you consolidate payroll with Remote. To learn more about how we can help, speak to one of our friendly experts today — or check out our in-depth payroll processing guide. Once you’ve signed an agreement, your service provider will need access to your data. Set up restricted user accounts, and only provide access to the systems and data that are needed for the provider to perform their tasks.

Recruiting, onboarding, and managing an internal finance and accounting team takes up a significant amount of time. By partnering with an outsourced accounting services firm, business owners can free up the time they would have spent managing their accounting department to focus on running their business. The best bookkeeping services handle your target tasks without breaking your https://www.quick-bookkeeping.net/ business’s budget, integrate with your accounting software and offer a dedicated line of communication with a live bookkeeper. In addition, consider the availability of add-on services like tax planning, payroll and human resources support. Outsourcing accounting services can also give you access to a high level of expertise and technology that you may not have in-house.

Bench: Best for bookkeeping + payroll

We work as a natural extension of your internal accounting team by providing insights, streamlined accounting processes, and collaboration with your existing staff to help you reach your goals. We partner with your business as either your full accounting team or an extension of your current department so you can focus on future growth. You will be more likely to find somebody with the appropriate level of expertise needed to manage your company’s finances, with better security and higher-quality results than an in-house accountant would be able to provide. From cost savings and access to specialized expertise to enhanced scalability and flexibility, this comprehensive guide is your roadmap to navigating the complexities of outsourcing in the realm of finance and accounting. Streamline accounting processes while delivering an excellent customer experience with timely invoices, payments and reports.

Finance and accounting outsourcing is only the beginning—RSM has the people, processes and technology to transform your finance department and, by extension, your company. In addition, RSM has a dedicated technology team that supports FAO resources to increase education, and we deploy emerging innovations to improve our outsourcing platform. In this way, RSM FAO enables more timely, actionable information to guide decision-making. RSM’s FAO technology is scalable, accessible through the cloud and provides real-time, automated reporting. We work with leading technology partners such as Oracle NetSuite, Sage Intacct, Intuit QuickBooks, Blackline, Tallie and Bill.com.

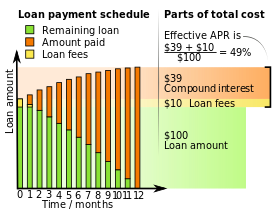

Recent trends have seen companies outsourcing more complex and valuable functions such as financial analysis, forecasting, and budgeting. Of all the outsourced accounting services, an outsourced CFO service is by far the most customizable. Whereas outsourced bookkeeping and outsourced controller work largely follow a predefined framework, an outsourced CFO relationship can be anything you want it to be. Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377. By comparison, outsourced accounting services typically cost a fraction of these rates and deliver better results.

- Set up restricted user accounts, and only provide access to the systems and data that are needed for the provider to perform their tasks.

- Accounting is a highly regulated and sensitive area that requires adherence to various laws, rules, and standards.

- Recently, an increasing number of companies has seen that outsourcing their finance and accounting function is a better, more efficient, and cost-effective financial solution that helps them boost business growth.

- We provide a wide range of outsourced accounting services to clients in a range of industries.

- In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business.

MicroSourcing ensures your data is secure and meets outsourcing compliance standards. Unlock the full potential of outsourcing with ease and discover the perfect fit for your organization. Our comprehensive range of offshore roles can help streamline your operations and make outsourcing simple. Learn how offshoring improves your productivity and helps grow your business.

Also, take all relevant steps to protect sensitive financial and employee information during data transfers. This will help minimize the potential for data misuse, keep your data secure, and ensure you’re compliant with any relevant data protection laws in your region. Directly engage with potential providers and request a meeting to discuss your needs.

To elaborate on how it helps organizations, this guide takes a look at what outsourced accounting is and its top benefits. First, analyze your accounting operations and determine which functions you’d like to outsource. Consider factors such as time spent on certain tasks, the level of expertise required, and the costs of performing these tasks in-house. Marcum’s Managed Accounting Services (MAS) Department is actively seeking a purpose-driven and client-facing, experienced Staff Accountant to join our growing team in Rockville, MD. MAS supports the accounting function for a variety of diverse clients, primarily in the nonprofit sector.

As you evaluate different outsourced CFO options, there are several things to bear in mind to ensure you make the right choice. By keeping these considerations in mind, you’ll be able to avoid any of the drawbacks that can impact businesses that partner with an outsourced CFO that isn’t a great fit for their business. It’s easy to think that the CFO role is journal entries for credit card transactions a position reserved for larger companies, but that doesn’t have to be the case. Many small to midsize businesses stand to benefit significantly from working with a CFO but tend to lack the resources to hire these experienced professionals. Much like outsourced bookkeeping, there are few disadvantages inherent in partnering with an outsourced controller.