Income and expenses are recorded in your books only when the cash hits your account or leaves it. Bench, which uses both software and human bookkeepers, also offers both methods, with cash basis being the default. Because this method gives you a more complete picture of your business’s finances, it’s more commonly used than the cash method. The cash method is also beneficial in terms of tracking how much cash the business actually has at any given time; all you have to do is look at your bank account balance. If you’re unsure which method makes sense for you, talk with your accountant or bookkeeper.

- With the accrual method, you record revenues and expenses when they are generated, regardless of when the money is collected or paid.

- Accrual accounting recognizes income and expenses as soon as the transactions occur, whereas cash accounting does not recognize these transactions until money changes hands.

- Most small businesses with payroll use accrual accounting, since payroll has both an accrued account and an expense account.

- We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

- A careful analysis of the pros and cons of both options will help you select the accounting method that best meets your company’s needs.

What is the accrual basis of accounting?

When transactions are recorded on a cash basis, they affect a company’s books upon exchange of consideration; therefore, cash basis accounting is less accurate than accrual accounting in the short term. The Tax Reform Act of 1986 prohibits the cash basis accounting method from being used for https://www.accountingcoaching.online/perpetual-inventory-definition/ C corporations, tax shelters, certain types of trusts, and partnerships that have C Corporation partners. While cash accounting is a viable option and often a good fit for smaller businesses, accrual accounting generally provides a more comprehensive view of a company’s financial health.

Problems with Cash Flow Reporting

That’s not to say it can’t be changed later—only that it’s harder to switch once you get comfortable with one way or the other. Accounting software and tools like QuickBooks Live can help with either method, with virtual accountants available to help you every step of the way. Having a publicly-traded company or one that may go public is another stipulation of the GAAP guidelines. Publicly traded companies have a duty to report an accurate view of their financial well-being to shareholders.

Stop Using Cash Accounting for Your SaaS Company

The cash flow statement tracks the non-cash add-backs and changes in working capital, among other factors that impact the cash balance. For that reason, for distressed companies facing a liquidity shortage, cash-basis accounting is used for internal purposes to share with lenders and/or the Bankruptcy Court. The benefit of cash-based accounting is that it tracks the amount of cash a company truly has on hand at any given moment. Moreover, a company’s expenses are not recognized until an actual cash payment is made (i.e., a real cash outflow).

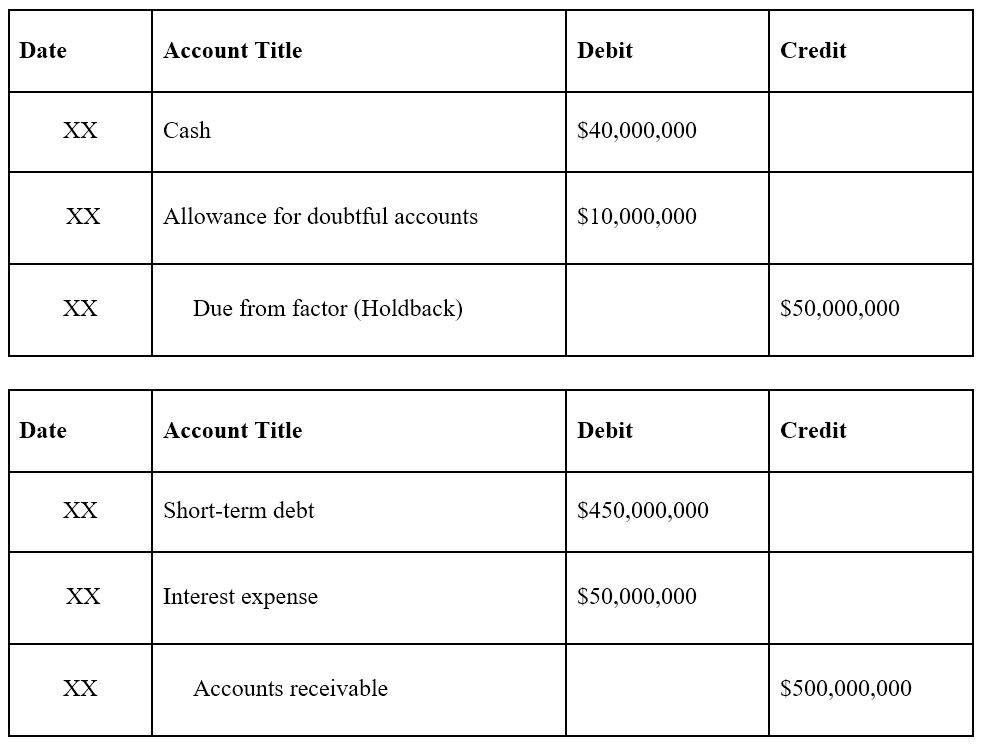

Accounts Receivable

Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and record expenses as they are incurred. Ramp makes it easy to keep track of your business expenses, giving you clear insight into your finances and more control over cash management. You’ll know exactly how much money your business earns and how much goes out.

They may choose to use the cash basis method because it’s more straightforward, making it a good fit for business owners who don’t want to bring in additional accounting support. If you manage inventory, trade publicly on the stock exchange, own a C corporation, or have a gross annual revenue of $5 million or more, the IRS requires you to use accrual accounting. is it canceled or cancelled Additionally, if your customers can pay you for products on credit, you should be using the accrual accounting method. Otherwise, you and your investors won’t have an accurate understanding of your finances. Cash-basis accounting is a simpler method of accounting that gives business owners a clear and straightforward understanding of their cash flow.

Then, in February, when you receive the payment, you’ll credit accounts receivable, which means receivables go down, and debits cash, which will go up. Though people commonly confuse accrual accounting with cash accounting, there are some stark differences https://www.business-accounting.net/ to know before choosing which is right for your business. Might overstate the health of a company that is cash-rich but has large sums of accounts payables that far exceed the cash on the books and the company’s current revenue stream.

Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out. This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid. The income statement is sensitive to stating income and expenses as they are paid or incurred. The balance sheet, on the other hand, has accounts like accrued liabilities or accrued payroll, which are also sensitive to the accounting method chosen. The statement of cash flows is affected by your choice of accounting method since net income will differ depending on the method chosen. The main difference between accrual and cash basis accounting is the timing of when revenue and expenses are recorded and recognized.

In this post, we’ll go over what you need to know about the accrual method of accounting, including its benefits, how it compares to cash accounting, and if it’s right for your business. Has your business reached the point where you’re ready to hire more employees or expand into new customer markets? As your business becomes more complex, it may be time to revisit whether accrual accounting will be more effective for your financial and tax reporting.

The Capital One Spark Miles for Business Card offers a higher earning rate of 2 miles per dollar on all purchases. It’s an enhanced version of the Spark Miles Select, providing greater rewards in exchange for an annual fee. A customizable rewards card that allows businesses to earn extra points in categories where they spend the most. Bank Triple Cash Rewards Visa Business Card, you’ll get an additional $500 cashback as an introductory bonus.

Companies that use Ramp save an average of 3.3% in their operating expenses in the first year and close their books faster. Continue reading to familiarize yourself with the cash vs. accrual accounting debate and make an empowered decision that steers your business on the right path. A careful analysis of the pros and cons of both options will help you select the accounting method that best meets your company’s needs. Whether an accrual is a debit or a credit depends on the type of accrual and the effect it has on the company’s financial statements. For example, if you provided a consulting service for $100 in January but you expect the customer to pay in February, you’ll have an accrued revenue of $100 in January.

Accrual basis and cash basis are two methods of accounting used to record transactions. It means your business’ income is not taxed until the money is in the bank, which is vital for many small companies with tight cash flows. For example, imagine a dental office buys a year-long magazine subscription for $144 ($12 per month) so patients have something to read while they wait for appointments. At the time of the payment, the dental office sets up a prepaid expense account for $144 to show it has not yet received the goods, but it has already paid the cash. When a company pays cash for a good before it is received, or for a service before it has been provided, it creates an account called prepaid expense. This account is an asset account because it shows that the company is entitled to receive a good or a service in the future.

This is common when customers pay for a subscription or have recurring payments, like a phone bill. For example, let’s say a customer paid $100 for your consulting services in January, but you’ll only be providing the service in February. Differently than accrued revenue, deferred revenues happen when a customer has paid for a good or service you haven’t yet provided.